The markets are demanding more accountability of national governments: but are they challenging the democratic political system around the world?

January 18, 2011 Leave a comment

The "Markets" are made up of people who sometimes act without reason...and sometimes they act because they can

The “markets” attack on Greece and Ireland, have forced both these countries to accept economic bailout packages from the EU-IMF, and with it a series of strict austerity measures which restrict the spending of governments. The austerity measures force the government to shut down spending, and raise economic rationalism to a new level. It is tough times for the citizens of these countries as the absorb the impact of lower wages, less government services and lower asset values.

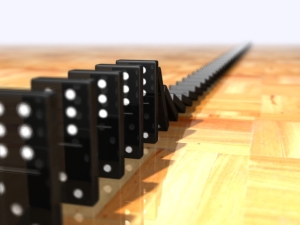

Ireland was encouraged by all and sundry in Europe to request an EU-IMF bailout package, and the chief reason amongst many was that it would give stability to the European financial system and prevent the failure of other European economies. I don’t accept this position, as it wasn’t proved accurate when US banks started to collapse in 2008, and it wasn’t true when European Banks started collapsing in 2008/09, and equally it wasn’t proved to be true when Greece accepted the bailout package and the associated austerity package. If acceptance of a bailout package was evidence of stopping the rot, then surely the “markets” would not have attacked Ireland, and demanded the same outcome. In all these cases the financial “markets” have been out for blood, and the forces at play on the floors of the exchanges and bond “markets” have focused their energies on one target until it has fallen, only for their scope to be moved to the next target. The market analysts tell us that it is more the case of the market correcting, and assessing the competence of companies and countries, and that serious concerns have been uncovered. In reality it is a domino effect, with one falling, the next one to fall is the next in line.

This domino effect is what the bailout packages are trying to prevent, through providing financial stability and assurance to a vulnerable economy. The problem seems to be that, the “market” wants these economies to have the financial stability and assurance provided by bailouts. The “market” is treating economies and countries as corporations. Publicly listed companies have their management, strategies, implementation, and financial stability assessed by the market in terms of their share price, and other capital raising tools. The markets have previously not been interested or at perhaps not been able to have a meaningful effect on the management decisions of sovereign states (countries), as that is the domain of the constituents of the country – or the electors. This is what politics is all about, we get to vote in the management (Politician or Party) we want, and the politicians who win essentially take a short term approach to managing the country, and make management decisions based upon the ability to please enough of the electorate to get re-elected….whether it is financially sound, economically feasible, commercially justified or not.

This domino effect is what the bailout packages are trying to prevent, through providing financial stability and assurance to a vulnerable economy. The problem seems to be that, the “market” wants these economies to have the financial stability and assurance provided by bailouts. The “market” is treating economies and countries as corporations. Publicly listed companies have their management, strategies, implementation, and financial stability assessed by the market in terms of their share price, and other capital raising tools. The markets have previously not been interested or at perhaps not been able to have a meaningful effect on the management decisions of sovereign states (countries), as that is the domain of the constituents of the country – or the electors. This is what politics is all about, we get to vote in the management (Politician or Party) we want, and the politicians who win essentially take a short term approach to managing the country, and make management decisions based upon the ability to please enough of the electorate to get re-elected….whether it is financially sound, economically feasible, commercially justified or not.

We think and speak of “Markets” as if they are an automated and influence free mechanism that weighs up the relative strengths and weaknesses of an organization, currency or country; however we must remember that markets are made up of people, who provide this analysis and people are not influence free. The people that work or are the “market” are now demanding to have a say in how sovereign states are financially managed. This financial oversight of the financial decisions of sovereign states probably came about when these same sovereign states essentially nationalized failing banks that were “too big to fail”, and incorporated their debt and bad management decisions into the overall debt of a country. This is exactly what Ireland did, when their major banks were too heavily indebted and were potentially about to collapse. The Irish government stepped in and bailed out the banks…..the problem is that the Irish government couldn’t actually afford to be burdened by the banks debt. The markets were in a position where they were required to refinance the Irish debt, and they decided that it was too much, and would only be financed at a premium…..unless Ireland accepted a Bailout package. The poor financial decisions of governments who have bailed out large institutions such as Ireland are now being punished by the markets….one country at a time. So the question is; are the markets exacting a greater influence over national governments than they have before? And will the constituents of these countries accept the new market controlled oversight of financial management?